AFC Leopards Corporate Task Force Report has recommended the transformation of Kenya’s oldest football club from the current Society to a corporate entity.

Pending ratification by the club’s Annual General Meeting slated for end of March 2025, the report names a Mixed Ownership Model as the preferred football structure.

The recommendations by the Task Force have been made after intense member engagement, civic education, case studies and consideration of the unique Ecological, Social and Governance dimensions surrounding AFC Leopards and the Kenyan sporting space.

The Mixed Ownership Model. (50+1 Rule and Sustainable Club Ownership) is widely regarded as the best long-term option among various ownership models in football.

Under this rule, club members and fans own over 50% of the club, ensuring that private investments are possible while preventing complete control by owners who may prioritize their personal interests.

This model upholds democracy within clubs, allowing members to vote for the composition of their club board and enabling the replacement of those mismanaging the team.

By keeping football connected to its roots and giving fans a voice, the 50+1 rule effectively maintains the integrity of the sport. This structure is equated to balanced growth, primed to offer the opportunity for financial growth without compromising the club’s identity.

By inviting investment into brands linked to the club and the football team itself, AFC Leopards can secure the resources needed for development while remaining true to its community roots.

The report recommends the incorporation of three entities thus the Holding Liability Company at the apex, and two body corporates comprising the SACCO as a legal entity for members to channel their investment, and a vehicle for the Strategic Investor(s) to channel investment into the Holding Company.

Whereas the members SACCO will constitute 51% stake, strategic investor(s) will uptake 49% of the stake.

The stake shall be reflected on the Board of Directors of the Holding Company at the ratio of 5 for the members SACCO and 4 for the Strategic Investor(s).

Apart from the principle objective of investing into the club they love, a SACCO by its nature will enable members access loans on the strengths of their investment, and also benefit from dividends when and if declared according to the fiscal policy and framework of the legal entity.

An Investment SACCO will also give members an opportunity to increase their individual investment according to their financial ability, thus increasing their chances of higher returns in terms of loans and dividends.

For smooth transition from the current society structure to a corporate entity, the report recommends the formation of a Transition Committee dubbed the Corporate Committee.

Its main agenda will be to supervise the establishment and incorporation of the two resultant legal entities thus the SACCO and Holding Company, as it awaits on the strategic investor(s).

The committee shall also be charged with setting up commercialization structures to reflect the new governance model as shall have been ratified by the AGM.

The report recommends that the Transition Committee shall consist of seven members— four from the Corporate Taskforce Committee and three additional members to be nominated by the NEC, for a period of one year with an option of half year extension.

Among the many findings of the report is the non-corporate aspect of the Kenyan Sports Act that needs urgent review to enable seamless commercialization of football in the country.

Other findings include the threat of crowd trouble (hooliganism) as an inhibition to corporate investment in the club, and the need for the club to tap into its traditional stronghold for member/fan recruitment and apportioning of a fair share of home matches to increase match day experience.

Further on findings, the report Identifies key areas that challenge optimum operations at AFC Leopards Sports Club as a member owned (community) model. It also names various revenue streams that were found to be key with an enabling governance structure, looked at within the prism of key strategies that successful clubs use to build sustainable businesses and remain competitive in the ever-changing world of football.

The report puts the club’s nominal value at Kshs 2 billion after capturing the unique value-driving aspects of a football club, such as its sporting performance, fan base, supporter loyalty/passion, rich history and commercial potential among others.

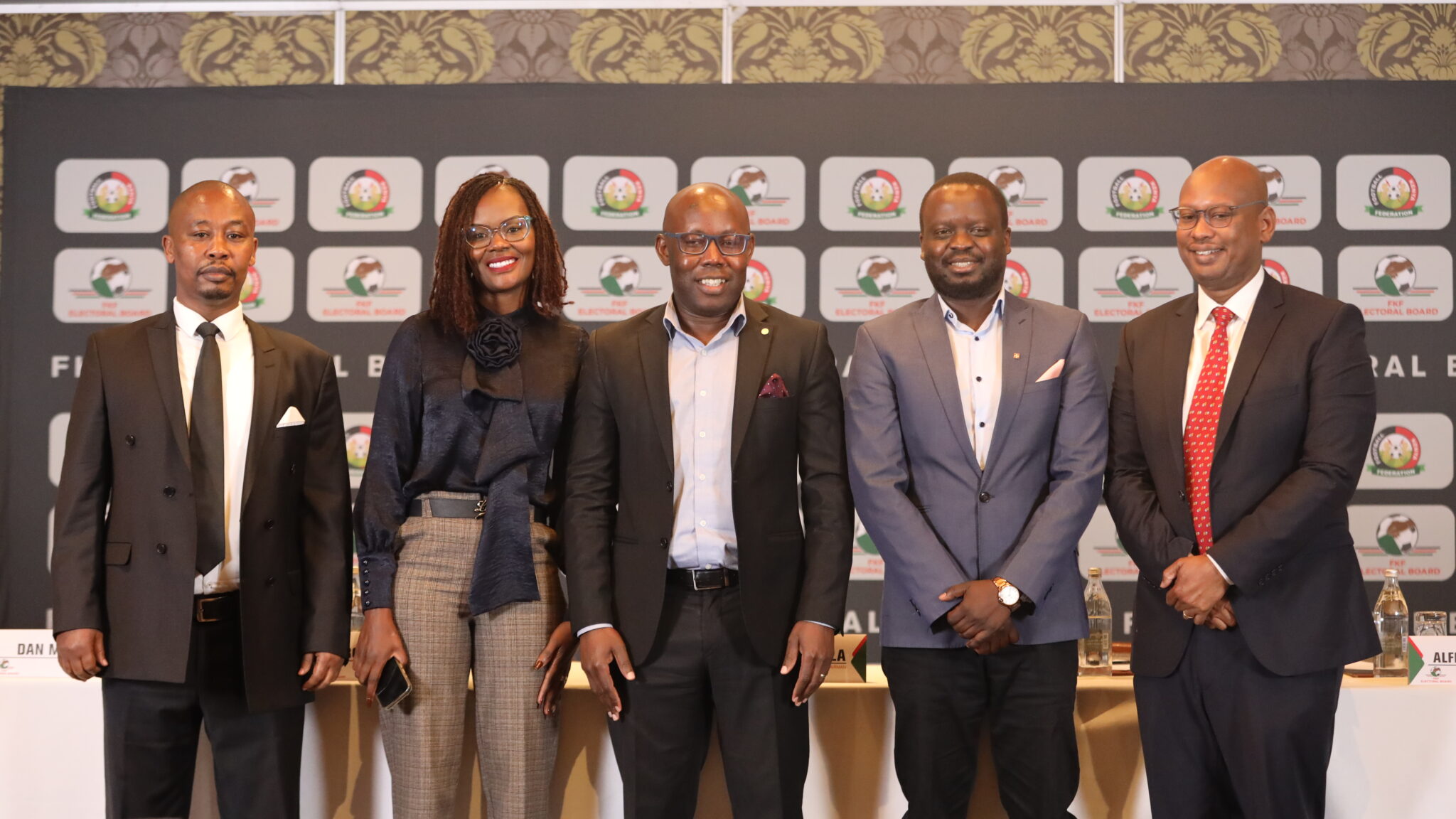

The report is as a result of a six months research and stakeholder engagement undertaken by an eight member Task Force Committee appointed on 28th August 2024 by the club’s National Executive Committee.

It was chaired by Vincent Shimoli with Richard Ekhalie as secretary and club patron Alex Muteshi as treasurer.

Other members of the committee are Laureen Ateka (assistant secretary), Ngarua Kamuya (consultant), Clarence Jumba, Bramwel Aino and Nelly Mwashi.