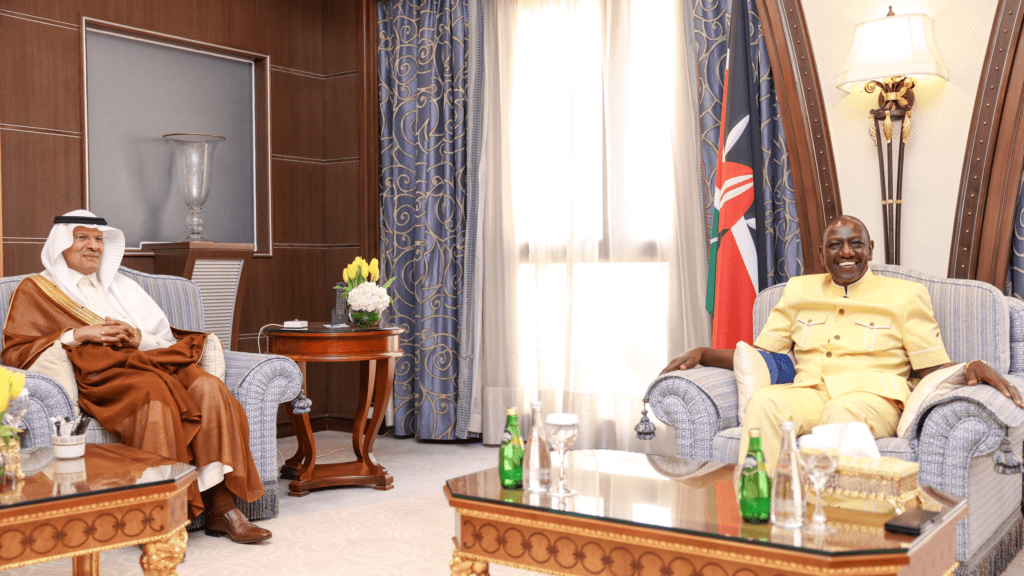

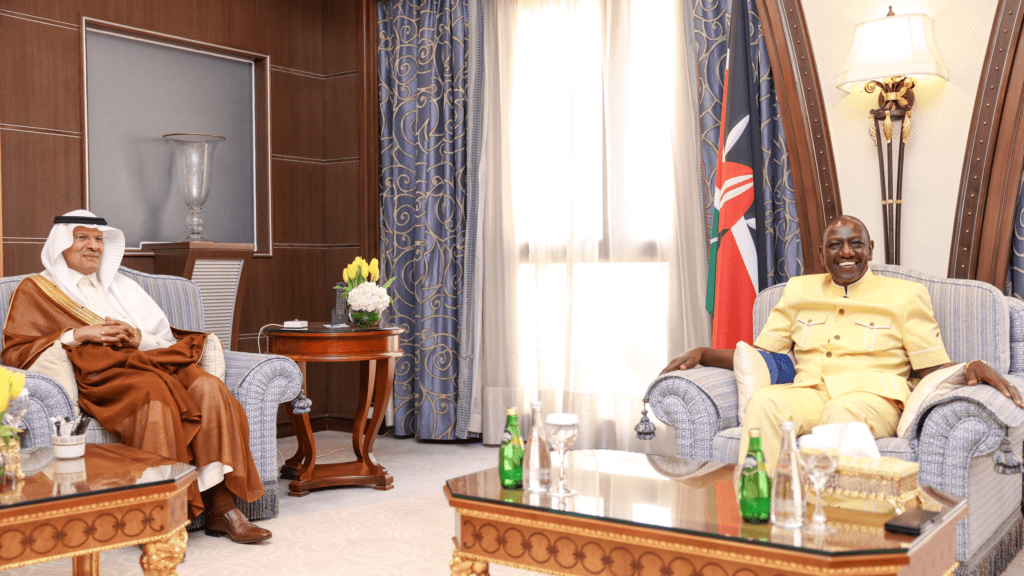

President Ruto withAbdulaziz bin Salman and Mohammed Al-Jadaan, Riyadh during his visit in UAE , 2023

The government led President William Ruto has opened talks for a Ksh193 billion ($1.5 billion) credit facility from the United Arab Emirates to plug Kenya’s widening budget deficit.

The loan will carry an interest rate of about 8.2 percent, according to Bloomberg, which reported the offering, though terms may change as discussions continue.

In the absence of the delayed money from the IMF, this UAE credit facility offers yet another lifeline.

In his statement, President Ruto said the need to get the funds on board was long overdue. “We must move with speed and seal this gap to sustain the smooth operation of essential services,” he said.

At the same time, the president did indicate that this deal would not compromise Kenya’s sovereignty or its long-term fiscal health.

This move comes just one year after Egypt received a massive Ksh4.5 trillion $ 35 billion bailout from the UAE. Kenya now joins the rank of African nations seeking relief from Abu Dhabi’s financial backing, ditto squeezed fiscally.

The friction between Kenya and the IMF persists, as it had its roots in the withdrawal of the Finance Bill 2024 by the Government of Kenya, which was part of the country’s bargain with the IMF.

The Bretton Woods Institution had planned to approve a Ksh77 billion loan disbursement on June 12. However, the decision was canned when the government pulled the bill.

“The IMF was set to approve a disbursement, but the withdrawal of the Finance Bill changed that,” US Ambassador to Kenya Meg Whitman told Citizen TV in an interview on August 28.

Whitman emphasized how important the IMF loan was, saying, “Kenya faces a very difficult situation, and I believe support should be given.”

To this regard, IMF officials visited Kenya to hold a six-day meeting over economic challenges. Leading the visit was led by the team leader of the IMF, Haimanot Teferra.