Kenya is set to receive a Ksh193 billion ($1.5 billion) loan from the United Arab Emirates (UAE) by the end of February, a much-needed financial boost as the government tackles mounting funding deficits in critical sectors.

Key Loan Details

The loan, agreed upon last year, comes with an interest rate of 8.2% and will be disbursed in a single tranche instead of staggered payments, contrary to earlier indications. This ensures the Treasury receives the entire amount at once, providing immediate relief for pressing financial obligations.

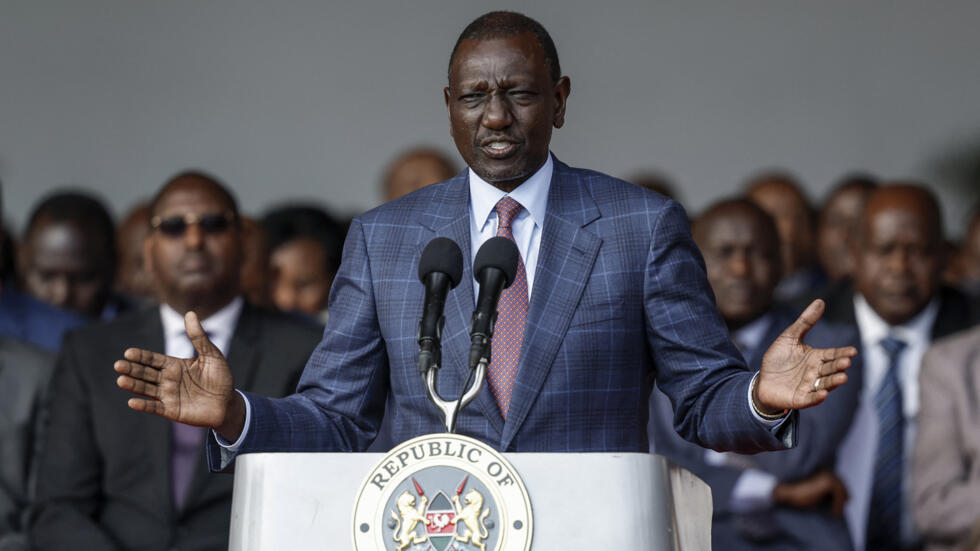

According to Bloomberg, the funds are expected to hit Kenya’s accounts during the final week of February, marking a pivotal moment for President William Ruto’s administration. The loan aims to alleviate funding gaps in sectors like health and education while reducing reliance on traditional lenders such as China, Eurobonds, and multilateral institutions.

Background and Financial Strategy

Initially, there were plans to stagger the loan disbursement in compliance with borrowing limits set by the International Monetary Fund (IMF). The first tranche of Ksh90 billion was expected in January, with the remaining amount scheduled for later months. However, the new arrangement allows for immediate access to the full amount.

Treasury Cabinet Secretary John Mbadi revealed that the government is exploring additional funding avenues, including a potential new loan program with the IMF before the current arrangement concludes in April.

“We might have indicators of a new program before April,” Mbadi told Reuters, emphasizing that options like Eurobonds remain on the table. “With our improving credit ratings, we could also tap into open markets for funding.”

Critical Needs in Health and Education

The loan comes at a time when Kenya’s Ministry of Health and Education faces significant budgetary challenges. The Ministry of Health requires funds to clear debts of Ksh30 billion owed to private hospitals, while schools have warned of potential closures due to inadequate financial support.

These sectors, vital to the nation’s socio-economic well-being, are expected to benefit directly from the UAE loan, offering a lifeline to keep operations running smoothly.

Strengthening Bilateral Relations

Kenya’s move to secure financial backing from the UAE underscores the growing importance of non-traditional partnerships in addressing fiscal challenges. By diversifying funding sources, the government aims to maintain economic stability and support long-term development goals.

As the funds are set to be disbursed shortly, all eyes are on the Treasury’s plans to allocate and manage the resources efficiently to meet the country’s urgent needs.